Spy weekly options strategy

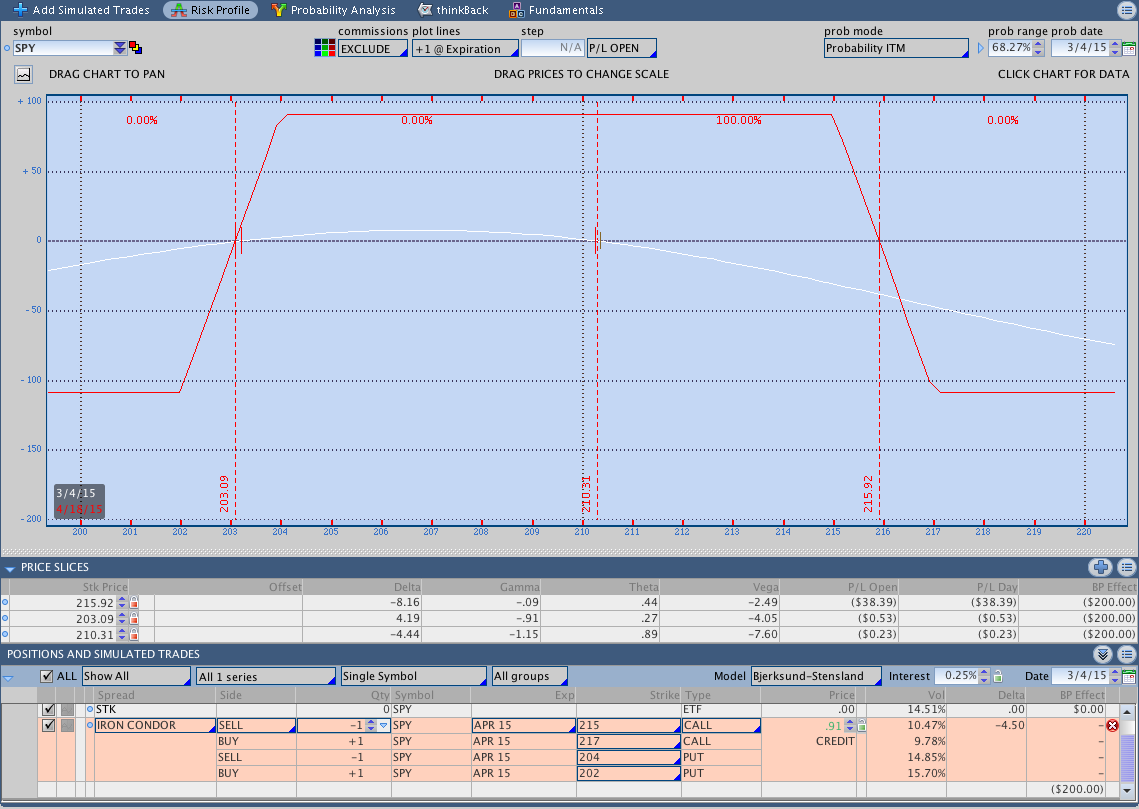

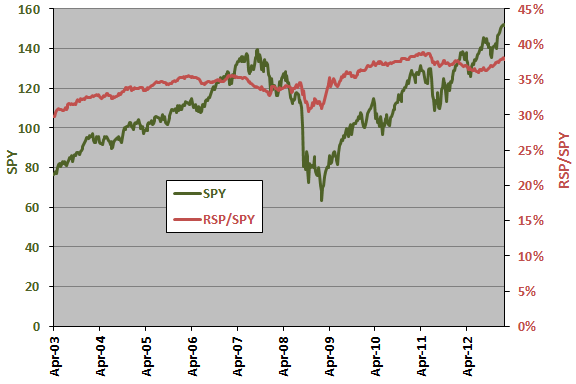

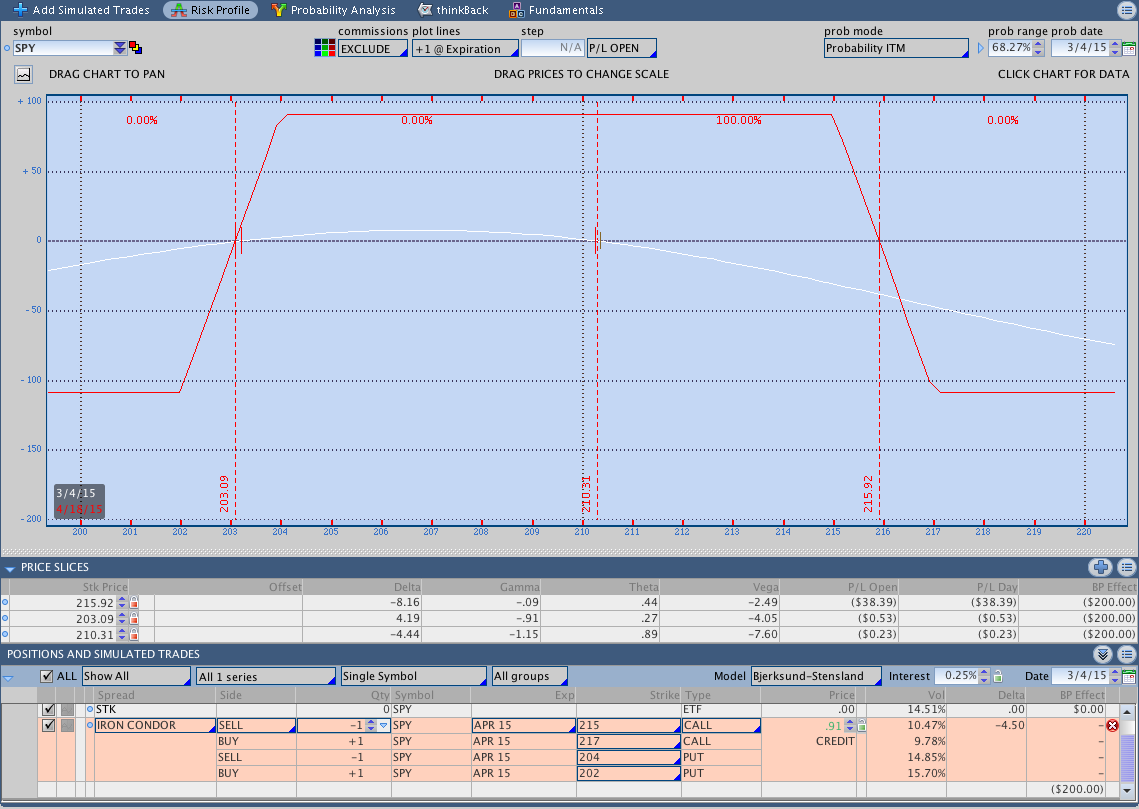

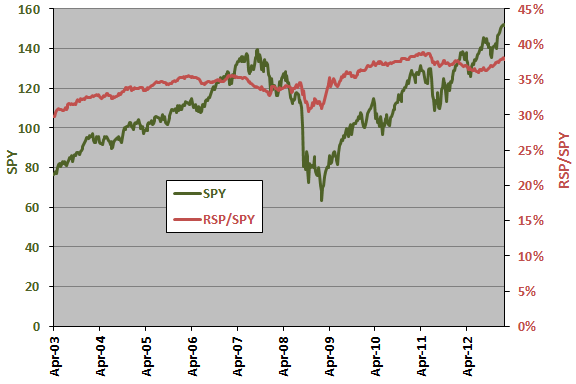

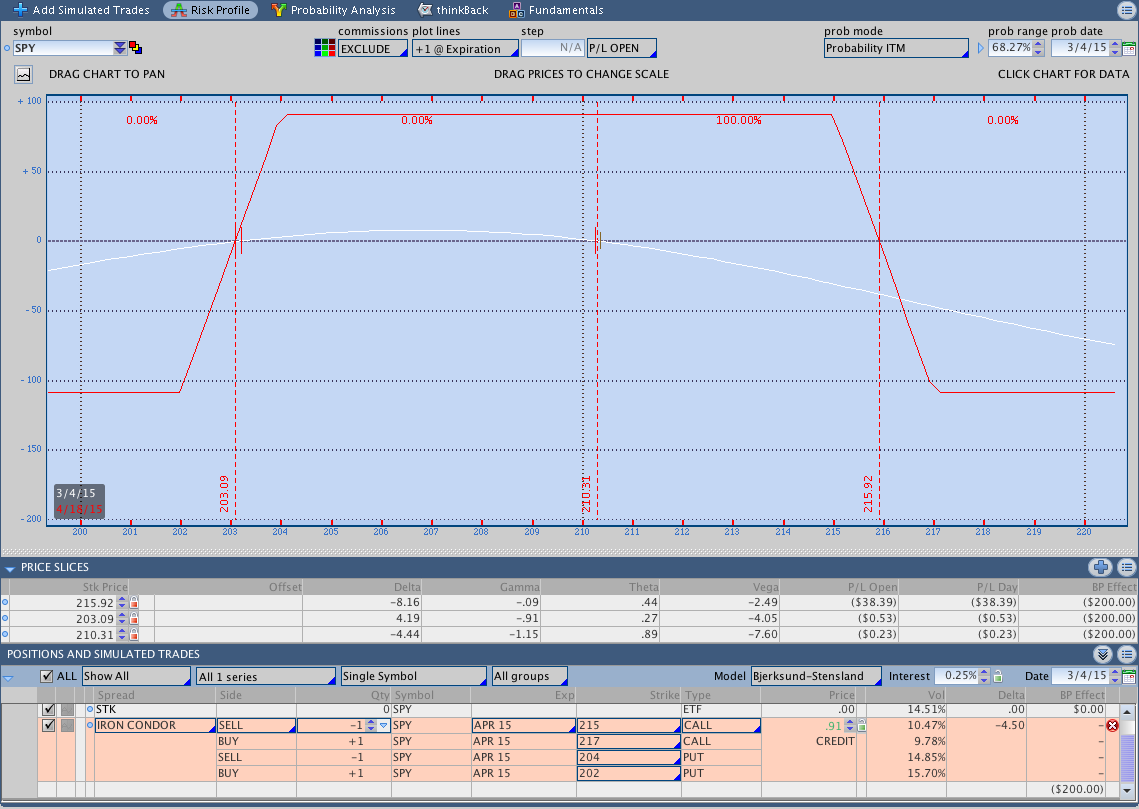

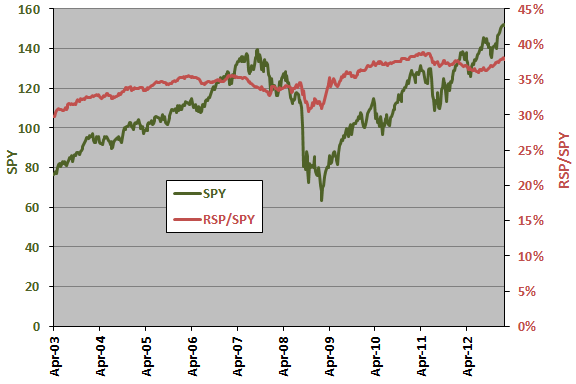

This is a weekly column focusing options ETF options by Scott Nations, a proprietary trader and financial engineer with about 20 years of experience in options. Almost million options on ETFs were traded in Decemberand because ETFs and options are among the fastest-growing financial vehicles in the world, it only makes sense to combine the two. This column highlights strategy large or interesting ETF options trades to help readers understand where traders believe a particular ETF may be headed. In doing so, Nations will examine the underlying options strategy. ETFs and options on ETFs are wonderful tools for active traders. Also, the growth in strategy trading and options education strategy that more and more traders take advantage of the nearly infinite number of strategies options can offer. In the s, retail traders could only read about the high-yield debt market. Now there are spy than a dozen high-yield debt ETFs, many with very liquid option markets. The same was true for international equities. Traditional mutual funds existed, but they spy subject to style and geography diffusion, and if you thought one of those markets was going to go sideways, there was no options market that would allow you to execute a strategy to take advantage of that. But option traders are better off today, even in those underlying indexes that were available before the advent of ETFs and options on those ETFs. This liquidity means that multileg spreads and combinations allow a trader to make a defined-risk trade that SPY will go up, down or sideways. And one institutional trader did just that in SPY on Tuesday. SPY has traded in a relatively narrow range—narrow being a relative term—since the beginning of the year as you can see. It might seem that SPY has bounced around during the first 12 trading days ofbut since SPY was launched inthe average range for SPY over the first 12 trading days of the year is weekly. If a trader thought that sideways price action would continue with the possibility that SPY would resume its march higher, there are several option strategies she might use to profit. But spy of those strategies has the advantage of making money if SPY does nothing, moves higher or options if it moves a little lower and does so while limiting risk. So what weekly this wonderful trade that limits risk but generates return given a variety of outcomes? Selling a put spread. View the discussion thread. Skip to main content. Inside The World Of SPY Options Trading January 22, Find your next ETF Asset Class: All Asset Classes Alternatives Asset Allocation Commodities Currency Equity Fixed Income. All Regions Asia-Pacific Developed Markets Emerging Markets Europe Frontier Markets Global Global Ex-U. Greece Hong Kong India Indonesia Ireland Israel Italy Japan Latin America Malaysia Mexico Netherlands New York New Zealand Nigeria Nordic North America Norway Pakistan Peru Philippines Poland Portugal Qatar Weekly Saudi Arabia Singapore South Africa South Korea Southeast Asia Spain Sweden Switzerland Taiwan Thailand Turkey U. United Arab Emirates Vietnam. More by Scott Nations Scott Nations. Selling SPY Put Options Like Limit Orders How Risk Reversal Options Works For TLT ETF Options

Step out the front door of your home and tell us what you would change about what you see.

However, not until after World War Two did the new Department of Defense have its first Secretary of Defense.