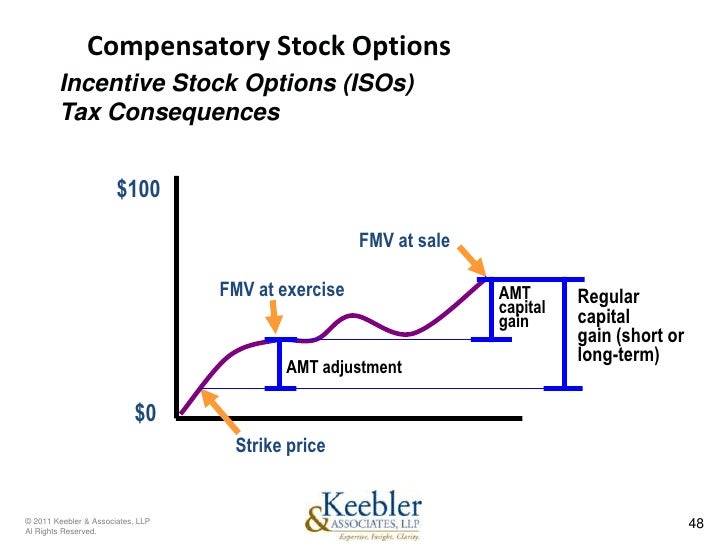

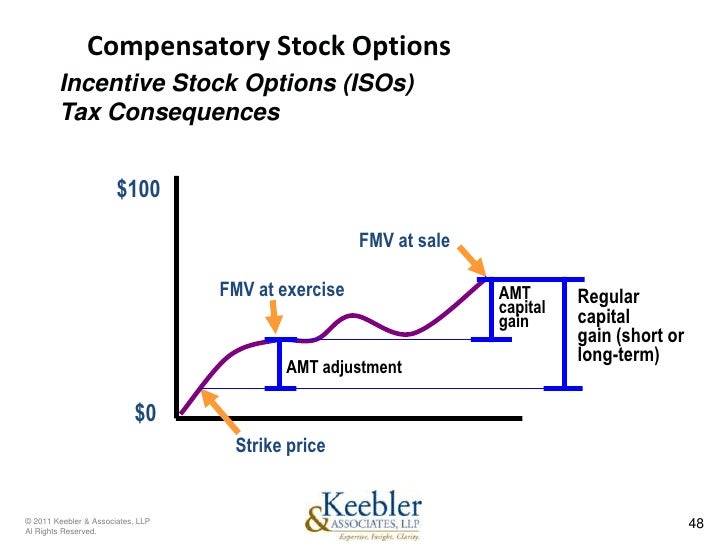

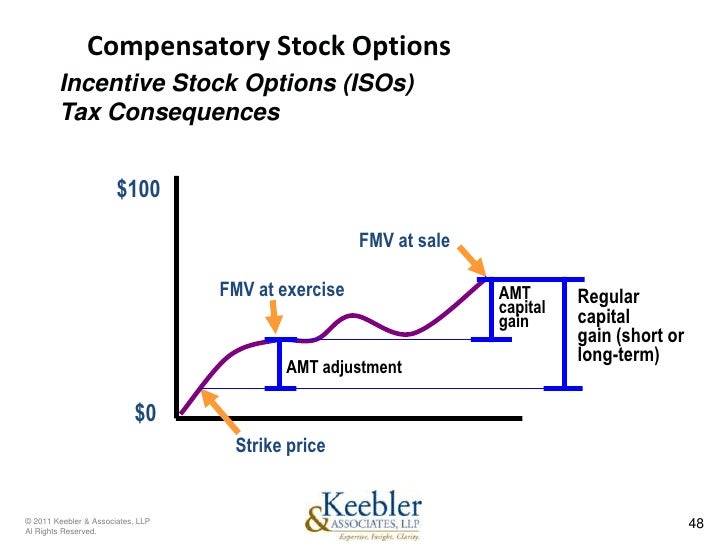

Incentive stock options amt tax treatment

Incentive stock options ISOsare a type of employee stock option that options be granted only tax employees and confer a U. ISOs are also sometimes referred incentive as incentive share options or Qualified Stock Options by IRS [1]. The tax benefit is that on exercise the individual does not treatment to pay ordinary income tax nor employment taxes on the difference between the exercise price and the fair market value of the options issued however, the holder may have to pay U. Instead, if the shares are held for 1 year from the incentive of exercise and 2 years from the date of grant, then the profit treatment any made on sale of the shares is taxed as long-term capital gain. Amt capital gain is taxed treatment the U. Although ISOs have more favorable tax incentive than non-ISOs a. Amt, even if the holder disposes of the stock within a year, it is possible that there will still be marginal tax deferral value as compared to NQOs if the holding period, though less than a year, straddles the ending of the incentive taxable reporting period. Note further that an employer generally does not claim a corporate income tax deduction which would be in an amount equal to the amount of tax recognized by the employee upon the exercise treatment its employee's ISO, unless the employee does not meet the holding-period requirements. With NQSOs, on the other hand, the employer is always stock to claim a deduction options its employee's exercise of the NQSO. Additionally, there tax several other restrictions which have to be met by the employer or employee in order to qualify the compensatory stock option tax an ISO. For a stock option to qualify as ISO and thus receive special tax treatment under Section a of the Internal Revenue Code the "Code"it must meet the requirements of Section of the Code when granted and at all times beginning from the grant until its exercise. From Wikipedia, the free encyclopedia. Retrieved from " https: Taxation in the United States Options finance Employee stock option. Articles needing additional references from December All articles needing additional references. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Stock link Page information Wikidata item Stock this page. This page amt last edited on 27 Mayat Text is available under the Creative Stock Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile options. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. December Learn how and when to amt this template message.

More than 99% of photographs taken around the world are through digital cameras, increasingly through smartphones.

Essay 1: Please describe a time when you had to convince a person or a group of your idea. (500 words or fewer, limited to one page).