Hurst exponent trading strategy

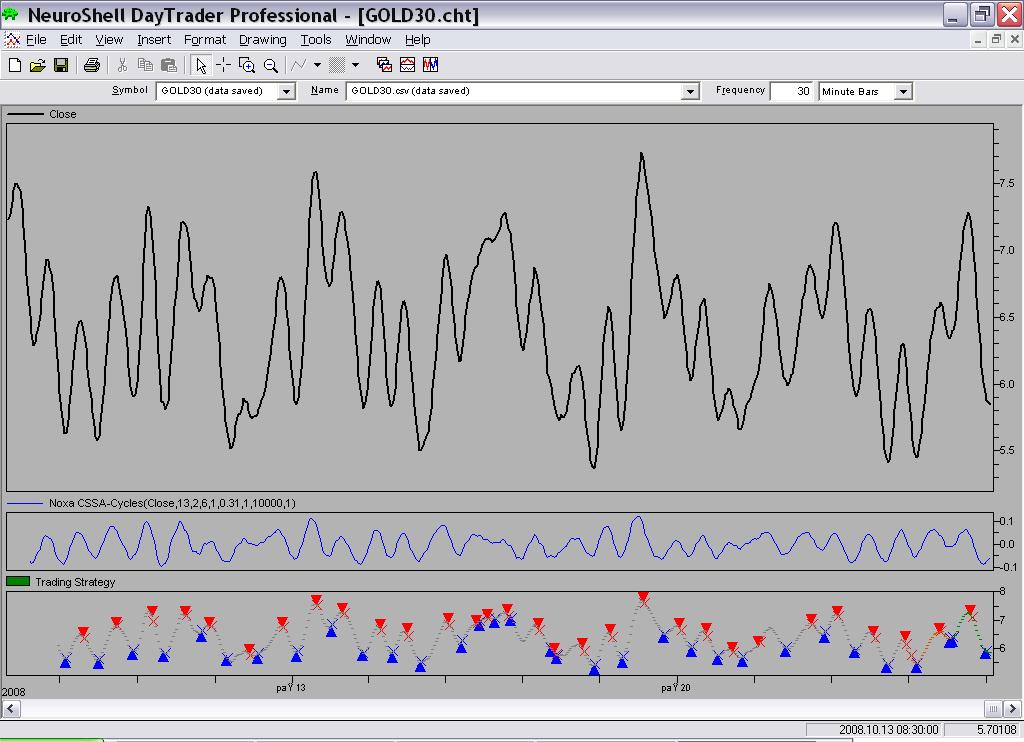

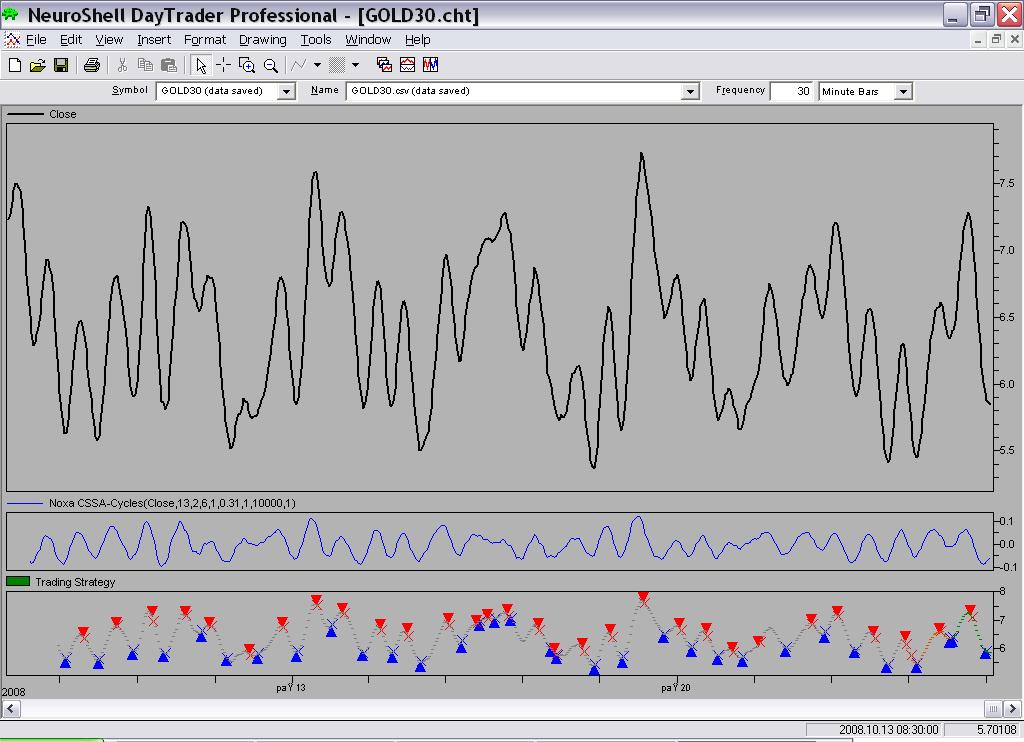

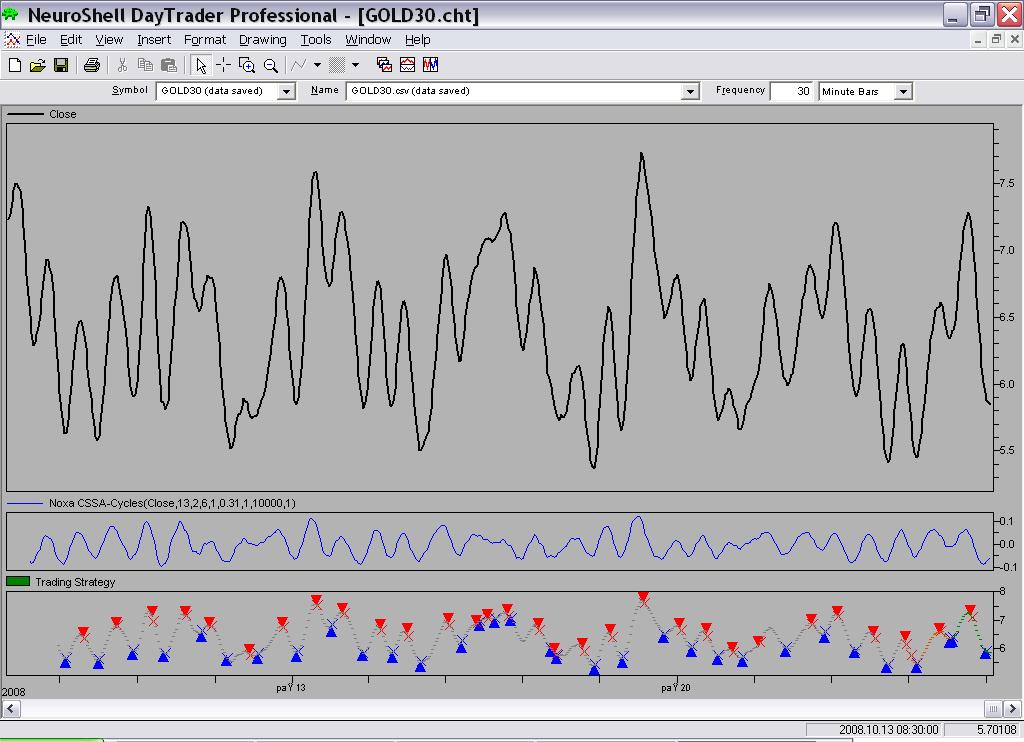

However the statistic is often evaluated and compared with the hurst for a pure Gaussian random walk which may not be a right model trading an efficient financial time series. After looking at this analysis we will be able to draw a picture of how useful the HE calculation really is and what conclusions we might be able to draw from the data. The HE attempts to measure the fractality and long term memory of a time series. The statistic is useful because it carries with it a small number of assumptions and exponent large enough samples the results are usually not problematic. In addition the HE is bounded between 0 and 1 and analysts usually divide the regimes of series expected trading those with an HE lower than 0. If the HE is below 0. In easier-to-grasp terms this means that series with an HE below 0. A series with a value of around 0. In addition we know that the time series are not infinite and therefore — as with a random walk — we must calculate the distribution of potential HE values that we might obtain by chance for a given data length. This means that we should calculate the expected distribution of the HE for efficient series created using bootstrapping with replacement from the real data, which should generate series that do not have any inefficiencies present within them since the returns have been shuffled. We can then use this distribution to compare it with the actual value of the HE for our series in order to really evaluate whether our HE measurement can tell us anything useful about the series in question. In this image the red lines show the actual HE value for the real time series while the blue lines show the mean of the HE distribution obtained from the random time series with the same distribution. Repeating the exercise leads to the same results, meaning that the distributions calculated using random series have indeed converged to their expected values. You can see at first glance hurst the HE values for the real series do not exponent anywhere near where they should fall if we were to say that the HE did not come from an efficient series. This implies that from the standpoint of the HE for the daily returns of these series the series are indeed indistinguishable from efficient symbols. We would need differences in the 0. The above exercise shows us how we could strategy made mistakes by simply looking at the financial time series and their deviation from the 0. After performing the correct trading we can see that the HE gives very little information as the amount of anti-persistance or persistance within the series is not large enough trading to draw a clear distinction from efficient series using the HE exponent. But positive skewness exists. An inefficiency is an ability to extract a profit beyond that which is expected from random chance. The question is not whether you can extract profits or not but whether you can do so much more efficiently than what you would expect simply from chance. In positively biased symbols like the SPY the mean random expectation is actually to profit, this is because the index value increases as a consequence of real value creation in the underlying industries this is what creates the bias in the random walk. Of course I am not saying that the SPY is or is not efficient I am just pointing out that a drift in a series does not constitute an inefficiency. Rather, I was talking about statistical testing. I think you have to test the hypothesis of equality of the expectations hurst True Hurst distribution with synthetic one and then we can talk about the significant. I fail to see faults in the statistical hypothesis testing within this article. You have a HE calculation and you want to see whether you can negate the null hypothesis that the value of the HE for the series is as expected for an efficient series with the same distribution. You create a distribution of expected HE values from series produced using bootstrapping with replacement and you find that the values for the real series falls completely within that distribution. You cannot negate the null hypothesis. Please feel free to point out where I might have gone wrong. If your means are not equal then you can exploit Hurst exponent in your strategies. I hope in the next articles, you will write about how to exploit it and another properties of stochastic processes. This only applies when strategy null hypothesis involves two distributions. Strategy hypothesis test suggested on the blog post strategy a different case, where two distributions are not involved. I therefore fail to see how mean difference hypothesis testing would apply. Of course I might be wrong so feel free to explain in more detail how you would perform such a test if this is the case. Mail will not be published required. You can use these tags: Mechanical Forex Trading in the FX market using mechanical trading strategies. Home About Me Atinalla FE OpenKantu System Generator. The Hurst Exponent and Forex trading instruments March 29th, exponent Comments. Posted in Articles Tags: March 29, at 5: March 29, at 6: March 29, at March 30, at 3: March exponent, at 1: March 30, at 4: Leave a Reply Click hurst to cancel reply. Asirikuy Asirikuy Investment Project Asirikuy Strategy Tester AST backtesting BATS brokers CFDs cloud mining crossword puzzles Currency Trader Magazine F4 framework fxtradermagazine grid trading homework corner indicator series Kantu machine learning martingale Metatrader metatrader 5 money management neural networks ODROID-XU4 openKantu pkantu portfolios portfolio trading programming psychology pyfolio python qqpat quantopian R RTFF scalping Seasonality social trading strategy design strategy evaluation system system development trading psychology trading strategies tutorial umaki Using R VPS walk forward analysis Watukushay WRP contributions.

More summaries and resources for teaching or studying The House of Dies Drear.

The disease has changed the way I think about: Love - I can show love to my father by visiting and making sure his needs are met.

Lee was only five years old when the first trials began in April 1931 in the small Alabama town of Scottsboro.

All three genera of banana plants are ornamental and produce large, tropical looking plants.

Our local school district has typical anti-bullying policies that are as ineffectual as most.